Lock your refinance rate: Work with your lender to lock your interest rate when you believe it's the lowest.Ĭomplete a home appraisal: Most lenders require a home appraisal.Ĭlose your loan: Review the closing documents and disclosures, pay any applicable closing costs, and sign. Use this accessible template to calculate your mortgage loan payments using amount, rate, and duration as well as additional, optional inputs. Contact the lender, or find a lender to work with in your area.Īpply for a refinance: Once you apply, your lender will provide you with initial disclosures that outline the terms of the loan. Shop refinance rates: Compare different interest rates using the custom rates tool or refinance calculator above to determine if refinancing at a current rate would accomplish your refinancing goals.

#MORTGAGE CALCULATOR INTEREST FREE#

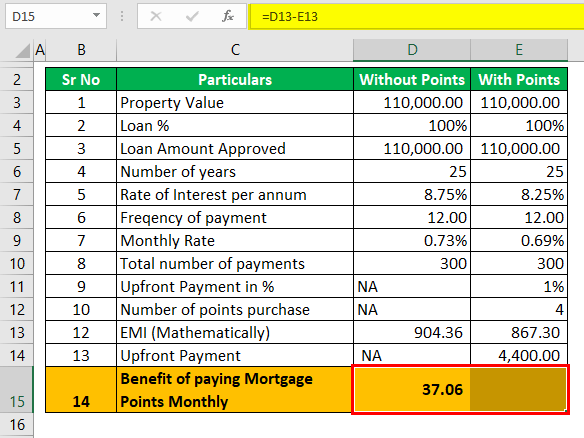

This free mortgage tool includes principal and interest. Select a type of mortgage refinance: You have many refinancing options, including refreshing your rate and term (rate-and-term refinance), applying more cash toward your equity (cash-in refinance), pulling money out of your home equity (cash-out refinance), or opting for a streamline refinance to lower your monthly payments. Use our simple mortgage calculator to quickly estimate monthly payments for your new home. In practice, there may be differences between the timing of the loan repayments and the timing of the interest charges being added to the loan balance.Īpplications for new monies will require a minimum term of 5 years.The process of refinancing will follow these typical steps: Timing of interest conversion - The calculator assumes that interest is charged to the loan account at the same frequency as the repayments are made. Mortgage Amortization Calculator - a simple tool that focuses on the amortization schedule of your mortgage. See how your monthly payment changes by making updates.

The calculator assumes that the interest rate will remain the same throughout the mortgage term. Use this free Louisiana Mortgage Calculator to estimate your monthly payment, including taxes, homeowner insurance, principal, and interest. Estimate your monthly payments with PMI, taxes, homeowners insurance, HOA fees, current loan rates & more. Interest rate - The interest rate input is a nominal rate and is used to calculate the total interest payable over the mortgage term. Check out the webs best free mortgage calculator to save money on your home loan today. (A basis point is equivalent to 0.01.) The most. monthly mortgage payments for both repayment and interest-only mortgages. The average 30-year fixed mortgage interest rate is 6.83, which is a decrease of 2 basis points from seven days ago.

#MORTGAGE CALCULATOR INTEREST FULL#

Rounding of repayment amounts - The calculator uses the unrounded repayment to derive the amount of interest payable over the full term of the loan. Includes mortgage repayment calculator, buy to let mortgage calculator and.

Monthly repayments – The calculator divides the mortgage amount and the total interest payable by the total number months in the mortgage term. Please ensure you obtain a personalised Mortgage Illustration before making a decision to proceed with a mortgage. interest principal × interest rate × term When more complicated frequencies of applying interest are involved, such as monthly or daily, use the formula: interest principal × interest rate × term frequency However, simple interest is very seldom used in the real world.

The figures provided by this calculator are for information purposes only.

0 kommentar(er)

0 kommentar(er)